Introduction to Polymarket

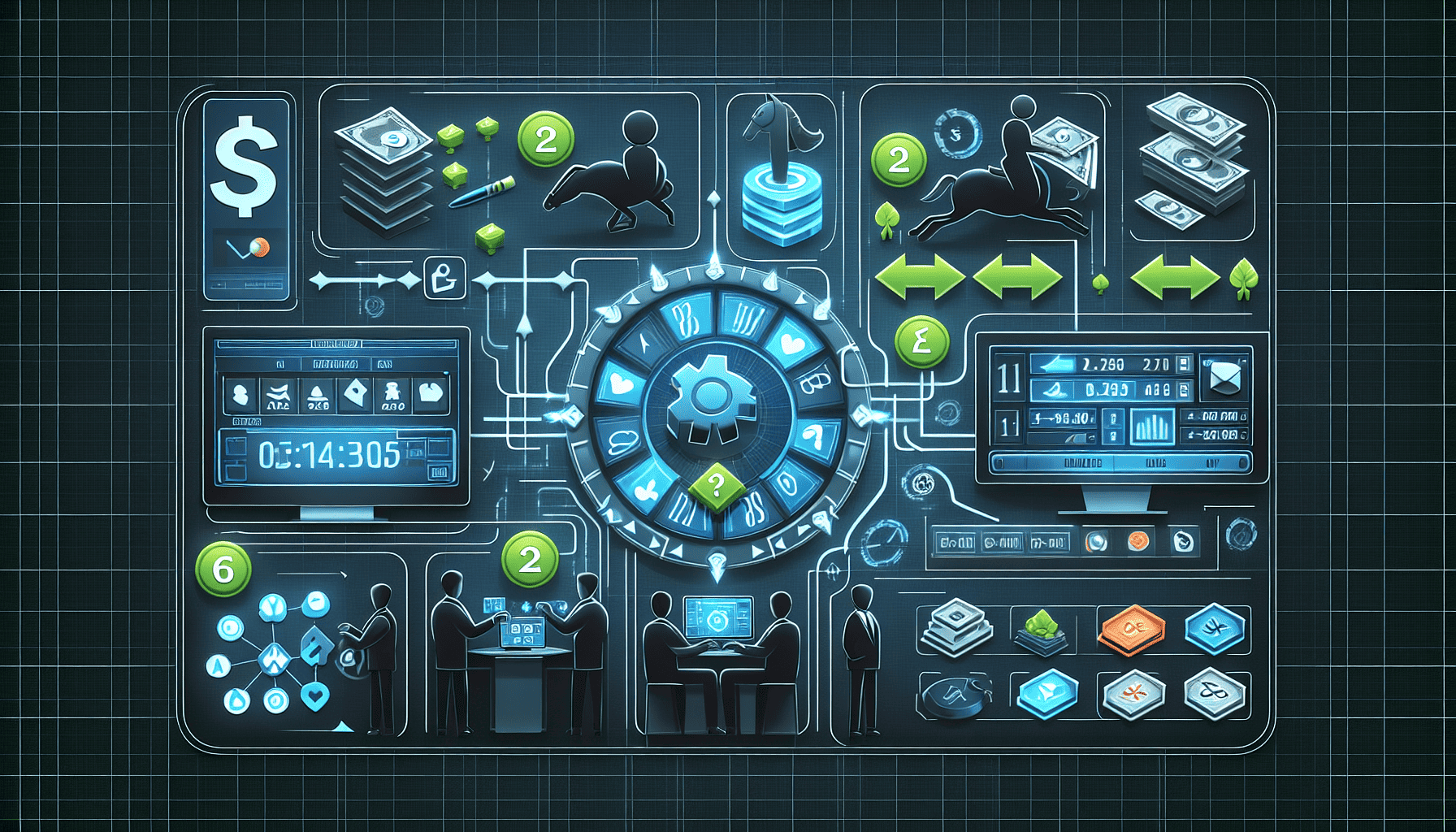

Polymarket emerges as a fascinating confluence of prediction, speculation, and information trading, allowing participants to delve into the realm of decentralized forecasting on a myriad of subjects. Unlike traditional investment consortia, Polymarket operates on an ethos of collective wisdom, harnessing the acumen of its users to anticipate future events through monetary incentivization. This peculiar market draws upon the axiom that the aggregation of diverse perspectives often trumps individual expertise, aspiring to metamorphose speculative foresight into a measurable asset.

At the core of Polymarket is its ability to transmute complex global events into discernible binary outcomes, providing users with the opportunity to trade on diverse topics ranging from political elections to viral phenomena. Each market is meticulously structured with a specific question and a binary set of outcomes—'Yes' or 'No'. Participants put their money where their convictions lie, purchasing shares that reflect the probability of each outcome. As the veracity of predictions becomes apparent, the market dynamically adjusts, with prices oscillating in response to the collective sentiments of its contributors.

What sets Polymarket apart is its foundational reliance on blockchain technology, ensuring every transaction is immutably recorded and transparent. This digital ledger vouchsafes the integrity of the platform, eliminating traditional financial intermediaries and engendering a trustless environment where users can participate freely. Moreover, the democratization of market participation eschews the exclusivity that plagues conventional exchanges, welcoming a panoply of voices irrespective of their financial clout.

For neophytes keen on navigating this innovative landscape, Check out our tutorial for step-by-step guidance on understanding the interplay between collective speculation and market-driven insights. It requires a synthesis of analytical rigor, intuitive judgment, and the willingness to adapt as new information emerges. As Polymarket continues to challenge the orthodoxy of prediction paradigms, it beckons a future where knowledge is not only prescient but tradeable, redefining the parameters of understanding in the information age. Explore our mobile app for betting on the go.

Getting Started with Polymarket

Embarking on your exploration of prediction markets via Polymarket can seem daunting at first glance. However, with a few straightforward steps, you'll quickly find yourself navigating the platform with ease.

To commence your foray, the initial step is to establish an account on Polymarket. This involves providing your email and creating a secure password. Once your account is active, it's imperative to familiarize yourself with the graphical user interface, which serves as the staging ground for your prediction activities.

Subsequent to acclimatizing yourself with the interface, the next pivotal step is to fund your account. Polymarket operates using the cryptocurrency USDC (USD Coin), necessitating the procurement of USDC if you don't already possess it. This can be achieved through diverse cryptocurrency exchanges that support USDC.

With a funded account, your next venture will involve exploring the manifold markets available on Polymarket. These markets span various topics, ranging from political events to technological advancements, allowing you to indulge in your curiosity while potentially capitalizing on your knowledge and predictions.

Once a market that piques your interest is identified, you'll have the opportunity to place a wager on the outcome you deem most probable. Each market displays the odds and potential returns, enabling you to make an informed decision about where to allocate your wager.

For those who benefit from visual aids, it's worthwhile to check out our tutorial for step-by-step guidance that elucidates the process further. Embracing these preliminary steps will set you on a trajectory towards becoming adept in the intriguing world of prediction markets on Polymarket. Also, don't miss out on the convenience of our platform by exploring our mobile app for betting on the go.

Placing Bets and Predictions

Venturing into the domain of Polymarket requires both acuity and precision in deploying your wagers and crafting prognostications. Commence by identifying a market that piques your intellectual curiosity—be it political events, financial indices, or unforeseen societal phenomena. Each market is fraught with potential and equivocal outcomes.

Initiate your endeavor by selecting an event with an uncertain resolution. Once you've located an enticing market, delve into the nuances of each outcome’s probability, perusing the community’s sentiment and historical data if available. Rigorously scrutinize these metrics to enhance your discernment.

Leverage your analytical prowess to determine the amount you are willing to stake. This requisite forethought is crucial in ensuring you wager with judicious restraint. Your capital allocation should be commensurate with your confidence in the hypothesis you espouse.

Engage in the betting process via a user-friendly interface, whether through a browser or the facilitative accessibility of the Polymarket mobile app. Execute your wager by selecting your desired outcome. The interface, seamless in its design, will guide you through finalizing your position.

Once positioned, the omphalos of excitement lies in the anticipation of the event’s culmination. Amidst the unfolding of events, remain vigilant and agile; the mutable nature of the markets may present opportunities to adjust your stance or hedge your bets for optimal outcomes.

Should you seek supplementary guidance on maneuvering through the intricacies of Polymarket, resources are at your disposal, including comprehensive visual tutorials that elucidate each step with clarity. Whether you are an aficionado of market prediction or a novice, cultivating a methodical and informed approach will undeniably enhance your acuity in this intellectual pursuit.

Understanding Market Outcomes

To navigate the intricate landscape of market dynamics, a profound comprehension of market outcomes is indispensable. Market outcomes are the culmination of myriad variables, both quantitative and qualitative, intertwining in a complex tapestry that drives the ebb and flow of market activities. These outcomes hinge on a confluence of supply and demand intricacies, consumer behavior, geopolitical shifts, and technological advancements.

One pivotal element in understanding market outcomes is the art and science of forecasting. Accurate market predictions equip stakeholders with the foresight to maneuver the market's undulating terrain. Forecasting involves dissecting historical data, identifying patterns, and leveraging sophisticated econometric models to project future trends. However, precision in forecasting is often obfuscated by market volatilities, necessitating adaptable strategies that account for unexpected contingencies. For those interested in mastering forecasting skills, check out our tutorial for step-by-step guidance.

To capitalize on these market outcomes, one must not only possess an analytical acumen but also an intuitive grasp of market sentiment. Earnings potential arises from identifying discrepancies between current market prices and intrinsic values. Astute investors exploit these anomalies through arbitrage and strategic positioning, thereby enhancing their profit margins. However, earning profits is not merely a function of fortuitous timing; it demands continuous vigilance, meticulous research, and a proactive stance in anticipating and adapting to market oscillations. Consider using our mobile app for betting on the go to stay ahead in the market.

In this quest for profitability, understanding market outcomes offers a strategic vantage point. By navigating the labyrinthine pathways of market forces with both dexterity and prudence, stakeholders can not only safeguard but potentially amplify their financial standing in the volatile yet lucrative domain of market enterprise.

Safe and Responsible Betting

Engaging in betting or trading on prediction markets like Polymarket can be a stimulating endeavor, offering both intellectual satisfaction and the potential for profit. Yet, to ensure this activity remains enjoyable, it is imperative to approach it with responsibility and safety in mind.

First and foremost, setting strict financial limits is essential. Allocate a specific budget that delineates your expendable capital, one that won’t impinge upon your essential expenses or savings. Committing to this budget in advance can prevent impulsive behaviors driven by momentary adrenalin rushes or the sunk cost fallacy.

Diligent research and understanding of the market dynamics are critical for informed decision-making. Before placing any stake, invest time in comprehending the variables and nuances of each market, empowering yourself with knowledge to gauge probabilities accurately. Moreover, diversifying your engagements can alleviate the risks tethered to any singular outcome, akin to the principles of a balanced investment portfolio.

Furthermore, it’s prudent to avoid emotional attachment to specific markets or outcomes, as personal bias can blindside objective judgment. Regularly reassessing your positions and being willing to walk away from unfavorable bets is a sign of prudence, not weakness.

Lastly, maintain a transparent and honest audit of your betting habits and outcomes. This continuous reflection allows for the detection of patterns or tendencies that may signal the need for a recalibration of strategy, ensuring that betting remains a positive and controlled aspect of your life. Embracing these strategies contributes to a responsible betting environment, safeguarding both financial health and mental well-being on platforms like Polymarket.